Sarah Tulej26 Jan 2022

I’m the kind of person that has always had multiple bank accounts, shopping around for the best deal (pre financial crash, in the days when banks were still handing out free cash).

And then, a few years ago I learned all about how investing worked.

I was horrified to learn that so many people - especially women - had no idea how to use their money to build their financial security. All while spending my working hours as a sustainability consultant, trying to persuade businesses to get serious about climate change and ecological breakdown.

A simple but compelling idea.

So when I discovered Friend’s of the Earth’s OwnIt programme, it was a match made in heaven. Women coming together to take action on climate change with their finances. I hosted a group back in 2020 and together we moved bank accounts, figured out our pension arrangements and ate quite a lot of pizza in the process.

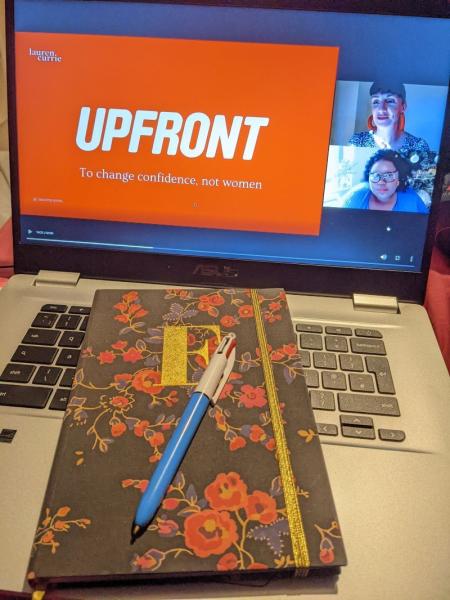

More recently I joined a community called UPFRONT which aims to improve confidence for 1 million women by 2023. It’s a confidence building course and platform where women come together to share their struggles and victories with work, money, confidence - and cheer each other on. Then I had a lightbulb moment.

We have more collective power that we know

Following the conclusion of COP26, and feeling frustrated at the lack of action on climate change by the rich and powerful I decided to reinvent OwnIt for the UPFRONT community. What both OwnIt and UPFRONT

Along with fellow UPFRONT member Stella McKenna, I designed and ran an hour long mini-OwnIt session with a small but committed group of women who gave up their Wednesday evening to explore the theme of personal finance and climate change.

Our aim was to identify where and how we could make changes in using our personal finances to tackle the climate crisis and take the small steps we never quite get round to, in a supportive setting. We would take my experience of participating in the OwnIt programme and link it to UPFRONT’s mission to build confidence.

“I should really know this stuff.”

So many of us struggle to understand how the financial system works and how our money is used when we put it in a bank account or our pension. And yet we all can influence how our money is used - from pensions, to bank accounts, insurance, even our food shopping.

A common theme when hosting these sessions has been the sense of guilt that (predominantly) well-educated, middle class, independent women don't fully understand how the finance system is at the root of so many environmental and social problems. It also feels opaque, overly complex and time-consuming to understand with a high chance of making the wrong decision with our money.

A major reason why we feel so unsure is that women tend not to talk about our finances and receive next to no education about how the system works. Furthermore there’s a taboo around discussing what we earn and what we do with our money, although I think this is slowly starting to change.

A massive 83% of women want to use their savings

Knowing this, we started the session by trying to dispel any guilt that the participants might have that they didn’t know enough about the financial system.

Indeed, one woman in our group said that she nearly didn’t come because she didn’t see herself as someone who has ‘finances.’ OwnIt exists to change that misconception.

Mapping our money and taking action

To help people make sense of where they could make a difference, we rapidly mapped out where each of us had a financial footprint - including our main source of income, banking, pensions, insurance, direct debits, daily spending, subscriptions and charitable giving.

We then looked at our money maps and considered where we could make changes so that our money was supporting action on climate change or more ethical business practices.

Very quickly our group came up with practical actions they could take, including:

- Moving their money from an ethically ‘bad’ bank account into the ethical one they opened a year ago and never got round to using.

- Making a deliberate choice to keep spending on things that make a positive impact, such as a clothing library subscription, rather than seeing it as an unnecessary expense.

- Diverting spending on Amazon in favour of independent businesses.

- Writing to their pension provider asking it to go green.

Our money is our power

What this exercise revealed is that everyone could identify something they could do with their money to make a positive impact regardless of their financial circumstances.

And this realisation - that our money is a source of power - can create the momentum for larger actions, such as lobbying our workplace for an ethical pension provider or shifting our investments to green funds.

Being part of a group of women that share a common purpose creates a feeling of safety and accountability. We know there are other people who will be our allies as we explore a topic that can be confusing and alienating, and who will be waiting to see how we get on in a month’s time.

The knowledge that our group is one of potentially thousands of other groups of women, all mobilising to move their money for the planet is inspiring. Will you be one of them?

How to get involved in Money Movers.

Follow my example and start talking to your own friends and family about taking climate action with your finances and create your own network of peer-support around you.

Sarah Tulej is a sustainability consultant and brand photographer based in Rotterdam.

Own It is now called Money Movers and you can access all the resources you need to get started with your own Money Movers group on our Money Movers resource hub.