Mary Stevens04 Oct 2019

Stop funding the things that destroy nature and pay for the things that help it. It is that simple.

Greta Thunberg’s call on us all to protect nature and start investing in the solutions is compelling. But for many of us the practice isn’t quite as simple as the theory. What if we don’t even know what we are funding? The total value of our pensions in the UK is a massive £2.6 trillion. Nine times out of 10 these savings – our money – are going into default funds that invest in the biggest companies in financial markets: fossil fuels, mining, big banks.

As Vandana Shiva put it succinctly, "it's not an investment if it’s destroying the planet". And the worst thing? Most of us have no idea.

Last autumn we set ourselves the challenge of figuring out how we could really make it simple to take climate action with our personal finance: our savings, pensions, investments – and even everyday spending. By getting deep into the topic we came up with a big idea: peer-to-peer support groups to motivate women to take climate action with their personal finance.

The start of something big

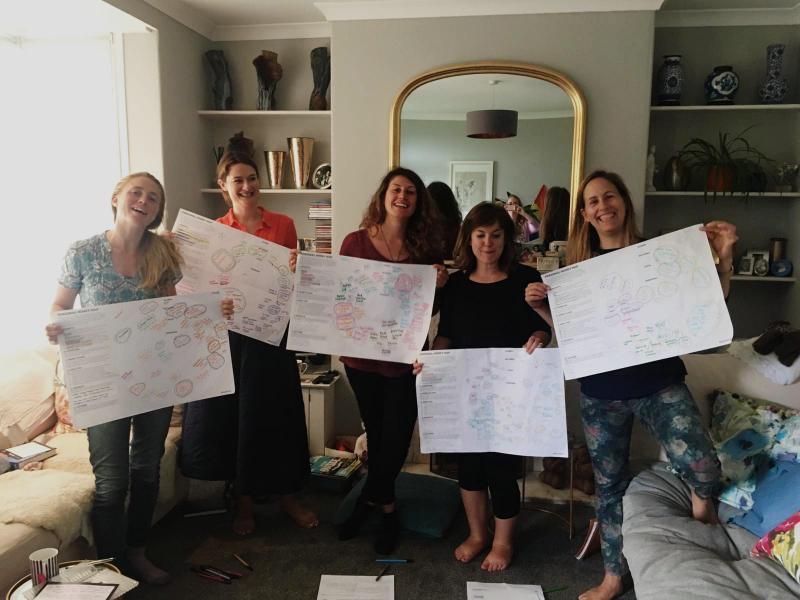

We decided to test whether women getting together with friends or colleagues in a familiar setting (at home, in a cafe or their workplace) could learn from each other and gain the confidence to take climate action with their money. A couch-to-5k programme for finances fit for the future we want to see.

It went so well we think it could be big. This is how movements start. Around kitchen tables, at the school gates, by word of mouth. But we want it to go further, and we want to harness the energy of a rising and determined cohort of women to demand meaningful change from the financial sector.

Read on to find out what we did, what we want to do next and how you could do it too.

Tackling a taboo and taking action: why women talking money works for the climate

Women are a core audience. Polling shows that respondents who identify as women care more about where their money goes and control an increasing share of wealth but are less likely to have savings or investments or to access financial advice. Right across the financial services industry, people are starting to wake up to the gender gap. But (as we told the Guardian newspaper) very few people are joining up the need for women to protect their own futures with their desire to secure a future for the planet (we wrote about this in more detail).

Change happens in a social context – where people connect and commit. Behaviour change is complex and is bound up with emotions and social ties. It’s not enough to simply provide more information to prompt people to move their money. We found that by creating a safe and relaxed space to talk openly about taboo subjects and encouraging women to commit to action with their peers, we were able to move more women from feeling anxious, dissatisfied or overwhelmed to taking action.

Financial empowerment and climate action go hand-in-hand. There is a powerful message at the heart of the F.I.R.E (Financial Independence Retire Early) movement, even if you don’t want to fully embrace the approach. When we exercise control over our money we’re less likely to make pointless purchases. We start to liberate ourselves from the growth-at-all-costs consumer economy. That’s good for us and it’s good for the planet. And as women, when we understand our finances better, we have more choice. This can mean reducing vulnerability and dependence on others in our financial lives (from partners, to parents, to financial advisors) but also more scope to get on top of debt and start making positive life choices.

I’ve felt hugely empowered and excited by these sessions. They’ve provided the push I needed at the right moment. It's dramatically changed how I think and communicate about money.

What we did

Our aim was to test the peer-group model, understand its potential – and the challenges.

After two prototype sessions in December 2018, we worked with Enrol Yourself months to pilot a peer-learning approach for women to take climate action with their finances. Ethex supported us with a small seed grant to help us get the idea of the ground.

Together we developed a model and resource kit and recruited 16 volunteer hosts in London and the South West. After a day’s training, they recruited peer groups from their professional and personal networks, totalling over 50 participants. We supported them throughout the programme, with further resources and coaching calls, if they needed help. And we gathered data through surveys and review sessions to help us understand what worked and what didn’t.

What we learned

The pilot helped us identify which aspects of the project participants most valued and what makes this a unique proposition.

Importance of face-to-face

Success depends on intimacy and trust. The face-to-face component of these sessions is essential. The programme can’t become an online-only offer.

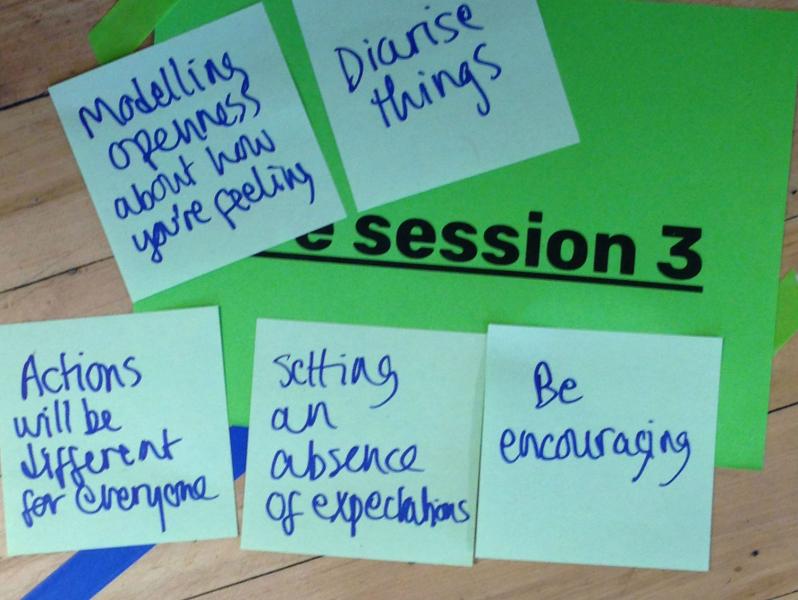

It's a collective journey

The programme is a collective journey, not a one-off event and the experience should always be informal. The hosts need to remain peers (i.e. not experts, or in receipt of any payment for their role) but they do need to take part in training to maintain the quality and uniqueness of this approach, and to ensure that they feel confident to tackle any issues that arise and hold a safe space.

Climate action

Finally, the focus of discussion and learning for the participants must be on climate action and understanding where our money is having the most impact. It’s easy to slip into a conversation about wider financial empowerment, or about relatively small-scale consumer choices so staying focused is important to maximise the opportunity.

I'm now far less fearful of tackling my finances, and also feel a healthy amount of responsibility to the group to get something done!

The difference we made

We used surveys to understand our impact in terms of both sustainable finance (what was the value of the actions taken), and impact on hosts and on participants (what did they learn, how did this experience change them).

I have more control than I realise, I just need to ask questions.

We were delighted that 100% of hosts and participants would recommend #Ownit (our working title) to others and 58% of participants would consider hosting their own group.

I have begun to learn to talk more openly and unashamedly about my money, my earnings. I have learned that I will learn more by being open. That we each have something to offer one another.

When we asked hosts and participants to put an approximate figure on the value of their subsequent actions they reported that in only 3 months they had taken actions to a minimum combined annual value of £257,000 with a further £608,000 of actions planned. (We gathered this data before all participants had completed the three sessions, so the actual values may be much higher.)

The actions they reported included: switching pension provider, switching bank accounts, taking out sustainable investments, switching mortgages and changing energy supplier. A number of participants had also taken or planned to take campaigning action e.g. lobbying their employers in relation to their pensions.

From a personal perspective, they also reported more confidence in talking about money and its impact. Hosts also reported significant boosts to wider professional skills (e.g. confidence in facilitation and initiating new projects).

I now have better relationships with my colleagues; clear actions I want to take; I am going to do some lobbying for the first time in my life; improved coaching skills; improved confidence facilitating and hosting similar things.

What we could improve

The strength of running pilots is that we can learn not only what works but where we can improve.

We need to ensure this approach speaks to a wider range of women, at different points on their life’s journey.

Our participants would also welcome improved resources such as intro videos to different topics, to help them with their own research and to use in the sessions. We need better tools for sharing knowledge, resources and insight. This will be particularly important as the project grows.

More challenging, the inequalities experienced by many women made participation hard, and reduced the time available for follow-up action. Women dropped out because they couldn’t find childcare, or because their partner’s work schedule took precedence. We need to find ways to develop a programme that supports women to carve out the time and space they need and enhances participant commitment.

What next

For this to take off and support many more women to do good with their money, we must grow with care.

In our next phase we will hone our materials and our support (both training and online). We will develop a visual identity and online presence that makes recruitment as easy as possible.

We will explore how we can adapt the approach to work better in a workplace setting, or to different life stages and the needs of women from different backgrounds. And we need to plan for long-term sustainability so that we can continue to support women to lead the transition to a financial system that protects all our futures.

Would you like to join this movement?

If you'd like to host your own group, visit our resource hub to access all the information you need. Or find out more by contacting us.